Upcoming Development Sceneca Residences in Singapore

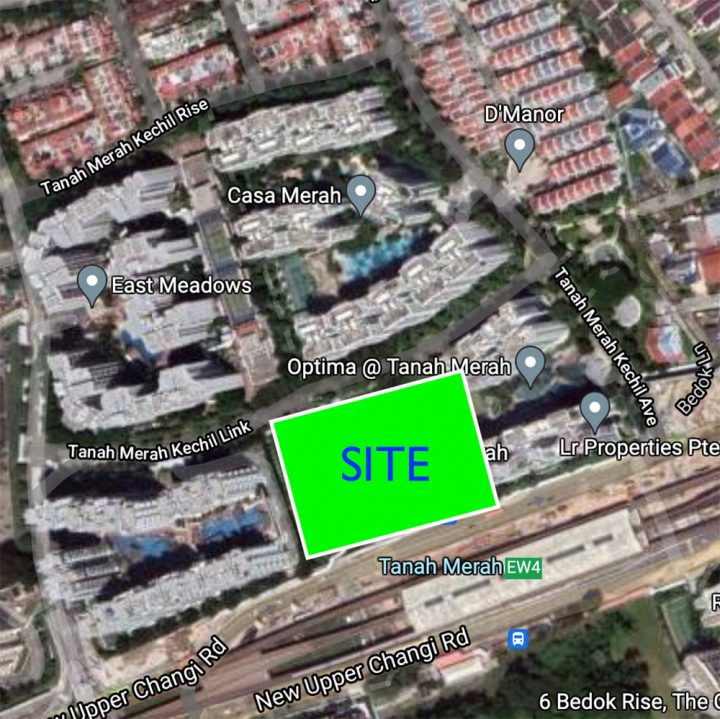

Sceneca Residences is a 99 years lease private condominium development situated along 26 Tenah Merah Kechil Link, located in D16 Bedok.

Extracted from factsheet of Official Sceneca Residences Site

Who is developing Sceneca Residences?

MCC Land is in charge of leading and developing Sceneca Residences, a private condominium development located in district sixteen’s Tanah Merah Kechil GLS Site consisting of 265 units.

The condo development is going to be built in a very modern and luxurious style. It will have plenty of facilities for residents to enjoy. The units will be furnished and ready to move into upon completion.

What is the price range of Sceneca Residences?

The launch price will be approximately 1700-2000psf. The facing of the units, room types, and levels will affect the final psf price of each individual unit

When will Seneca Residences TOP?

The estimated TOP date of Sceneca Residence is 2027 on paper, subject to approvals from relevant land agencies.

Surrounding Developements – Changi East Urban District and Tuas Mega Port

Terminal 5 at Changi Airport will proceed forward, and the terminal’s reopening will be associated with the Changi East Urban District , a business district distinguished by airlines and hotels that are poised to debut soon. Also, Changi East Urban District will improve its port aspect, unlike the current Changi Business Park.

This could improve rental prospects for nearby homes. There are many condos surrounding the Tanah Merah MRT station (including the upcoming Seneca Residence) that may attract workers from this growing Changi hub; likewise for condos along the Upper Changi Road stretch.

Cost of Living and Challenges and Inflation

Speaking at the National Day Rally, Mr Lee acknowledged that the cost of living is something that is at the “top of everyone’s minds”.

The Prime Minister said the Government is “doing everything necessary” to support Singaporeans, especially middle- and lower-income families.

This includes cash payouts, rebates under the GST Voucher-U Save scheme and for service and conservancy charges, Community Development Council vouchers and MediSave top-ups.

Does this mean that the prices of Sceneca Residences will increase significantly?

The Eastern district is close to Changi airport and is home to districts 16 (Upper East Coast), 17 (The Far East), and 18 (Tampines).

The Eastern district is a fast-growing business hub and is home to international restaurants from different countries and access to outdoor activities and parks.

While we may see inflation coming into effect, the prices of valuation of East side properties will generally increase overtime due to the urban developments mentioned above. This means that there will be a higher demand for housing in the East as residents will have a convenient access to all the amenities in the city.

If you decide to buy a property in the Eastern district, it is a good idea to purchase early. This will help you to get the best deal and you can make sure that the property you are buying is suitable for your needs.

For more info: scenecaresidences-official.sg/

Recent Comments